Many people believe an Oregon durable power of attorney is easy to create. It is important to know that document execution errors could make vital paperwork invalid at the time you need it most.

Oregon’s law doesn’t explicitly require notarization for power of attorney documents. However, experts strongly recommend getting your signature notarized. Banks and most financial institutions won’t accept your POA without notarization. The state allows power of attorney documents to be either witnessed or notarized. A clear understanding of Oregon’s power of attorney requirements will help you avoid major problems down the road.

This piece explains the reasons to notarize your POA document and what makes Oregon’s power of attorney “durable.” You’ll learn how to ensure institutions accept your document. PDX Signing brings fast, professional, and mobile notary services right to your door—whether it’s your home, office, or a coffee shop. Oregon’s law automatically makes your POA durable – it stays effective even after incapacitation – unless you specify otherwise. The document’s proper execution is a vital part in ensuring its acceptance.

Understanding Oregon Durable Power of Attorney

Oregon’s interpretation of “durable” carries a lot of weight when it comes to powers of attorney. Oregon law stands out from other states because it doesn’t use the term “durable,” but establishes this concept through specific legal provisions.

What makes a POA ‘durable’ in Oregon?

Oregon’s durable power of attorney stays effective even if you become incapacitated. Oregon law makes all powers of attorney work as durable documents automatically unless stated otherwise. Your agent can keep making decisions on your behalf if you become financially incapable.

Oregon Revised Statutes clearly state that “all acts done by an agent under a power of attorney during a period in which the principal is financially incapable have the same effect, and inure to the benefit of and bind the principal, as though the principal were not financially incapable”.

Why do people choose durable POAs?

People choose durable powers of attorney to protect their finances and gain peace of mind. These documents make sure someone can handle your affairs if you can’t do it yourself. Your family might need to ask the court to appoint a conservator without a durable POA. This process costs money, takes time, and becomes public record.

People with progressive conditions like Alzheimer’s disease often create durable POAs. This ensures their affairs stay managed according to their wishes as their condition progresses. Durable POAs also help prevent family disagreements about decision-making authority.

Oregon power of attorney laws you should know

Oregon powers of attorney follow these key provisions:

- Automatic durability – POAs stay effective during incapacity unless specified otherwise

- Immediate effectiveness – Your POA starts working when executed and continues until revoked, unless stated differently

- Springing provisions – You can create a “springing” POA that only starts working after a specific event, like incapacity

- Termination conditions – POAs end when you die, and you can revoke them while competent

- Divorce impact – Your spouse’s authority as your agent ends automatically when either of you files for divorce

You can choose who determines if you’ve become incapacitated. A physician can make this determination in writing if you haven’t designated anyone. Your agent must report to your court-appointed conservator if you become incapacitated.

Note that Oregon’s power of attorney laws don’t require notarization, but getting your document notarized makes it more likely that financial institutions and other organizations will accept it.

Does an Oregon Power of Attorney Need to Be Notarized?

Many people get confused about the notarization requirements for an Oregon durable power of attorney. Let me explain the legal requirements and best practices to make sure your document works when you need it.

Legal stance on notarization in Oregon

Oregon’s laws can be tricky on this matter. The state law says a power of attorney needs either witnesses or notarization to be valid. Things get complicated because some administrative rules say documents that grant power of attorney need the principal’s notarized signature. The notary information must appear on the same page as the signature. FindLaw states that “a notary must acknowledge your signature on the power of attorney document”. This creates some uncertainty about the exact legal requirements.

Why is notarization strongly recommended?

You should get your document notarized even if it’s not always required by law. A notary’s signature helps prevent fraud by confirming your identity as the signer. The state appoints a notary public as “a person of proven integrity to act as an impartial witness”. The notarization proves you understand what you’re signing and confirms you’re the person signing the document. This makes it less likely someone will challenge your POA later.

Bank and institution requirements

Banks usually have stricter rules than state law minimums. Most banks won’t accept a power of attorney that only has witness signatures, even though Oregon law allows it. Your POA might be useless at critical moments without notarization. Banks are extra careful about accepting POAs because they want to avoid legal problems. You should check with your bank about their specific requirements before you finalize your documents.

Witness vs. notary: what Oregon law says

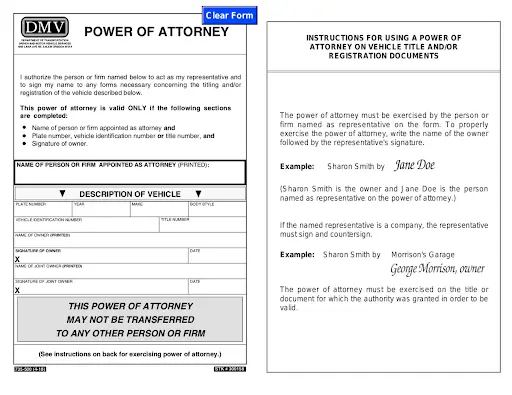

Oregon laws make a difference between various types of POAs. Standard financial powers of attorney need either witnesses or notarization. The rules change for healthcare directives. Oregon law (ORS 127.707) says these documents work only if the principal signs them and gets either “signed by two competent adult witnesses” or “notarized by a notary public”. Real estate transactions in your POA always need notarization.

Risks of Not Notarizing Your POA

You need to consider notarization when creating an Oregon durable power of attorney for yourself or a loved one. Skipping this step could create serious problems. Let’s get into what might go wrong with an unnotarized POA document.

Why a POA Gets Rejected

Banks and financial institutions carefully inspect power of attorney documents before they accept them. They reject POAs for several key reasons:

- Doubts about document validity or the agent’s authority

- Risk of lawsuits or liability

- Company policies that need specific forms or wording

- Lack of certifications or proper witnesses

Every institution has its way of interpreting these requirements. This creates confusion between different branches. Your POA might face rejection if it doesn’t match an institution’s specific policies.

Real Estate and Banking Challenges

Real estate transactions often hit roadblocks with unnotarized POAs. A badly written or incorrectly executed POA can create uncertainty that stops property sales dead in their tracks. Banks might ask for extra paperwork or review your POA multiple times. This leaves your agent unable to act during crucial moments.

Most financial institutions refuse to accept unnotarized POAs for property deals. This becomes a huge problem during emergencies or time-sensitive situations.

Legal and Family Disputes

Family members or other interested parties who disagree with your agent’s choices can easily challenge unnotarized POAs. POAs give significant powers to your agent, so these documents must hold up under close inspection. This is crucial when dealing with valuable assets or disputed decisions.

States that follow the Uniform Power of Attorney Act (UPOAA) require notarization for the document to work across state lines. Your document might become useless outside your state without this formal step.

Notarization Protects Your Agent

A notary’s seal helps prevent fraud by confirming your identity and making sure you want to sign. This protects both sides – you’re safe from unauthorized actions, and your agent stays protected from claims of forgery, fraud, or theft.

Proper notarization helps your agent avoid possible criminal charges if anyone questions the document’s authenticity. This extra validation makes your POA more acceptable everywhere, which helps your representative avoid unnecessary hassles during already difficult times.

How to Properly Notarize and Store Your POA

Your Oregon durable power of attorney needs specific steps to ensure its validity and acceptance by financial institutions. A proper execution and storage process will save time and prevent rejection.

Oregon’s law states your notarized signature must appear on the same page as the notary information. On top of that, it needs your agent’s signature and address. Legal experts suggest including your agent’s sample signature, which makes identity verification easier.

Safe storage becomes vital after notarization. The original document should stay in a secure yet available location. Here are some storage options:

- Place it in a fireproof safe at home

- Store it in your safe deposit box (your agent should be an authorized signer)

- The county recorder’s office should have it on file if real estate is involved

The next step involves sharing copies with key parties:

- Your designated agent

- Alternate agents (if any)

- Financial institutions where you have accounts

- Healthcare providers, if applicable

Signing a new copy every year or two keeps the document current. This approach helps avoid issues with institutions that don’t accept “stale” powers of attorney.

Real estate transactions require notarization and county recording. This makes proper execution even more significant. Don’t let paperwork slow you down. Whether you’re closing a loan or need general notary work, PDX Signing is just a call or click away.

FAQs

Q1. Is notarization mandatory for an Oregon durable power of attorney?

While not strictly required by law, notarization is strongly recommended. Most financial institutions and banks typically require notarization before accepting a power of attorney document.

Q2. What are the witnessing requirements for an Oregon power of attorney?

In Oregon, a power of attorney can be either witnessed by two competent adults or notarized. However, for increased acceptance and validity, notarization is generally preferred over witnessing.

Q3. What are the risks of not notarizing a power of attorney in Oregon?

An unnotarized power of attorney may be rejected by financial institutions, cause problems with real estate transactions, and be more vulnerable to legal challenges or family disputes.

Q4. How should I properly execute and store my Oregon durable power of attorney?

Sign the document in the presence of a notary, provide copies to relevant parties, and store the original in a secure yet accessible location such as a fireproof safe or safe deposit box.

Q5. Does an Oregon power of attorney need to be renewed periodically?

While not legally required, it’s advisable to sign a fresh copy every year or two to keep the document current and address concerns some institutions may have about accepting older powers of attorney.